DWX: Updating The Thesis On This Worldwide Dividend ETF – Searching for Alpha

marchmeena29/iStock by way of Getty Pictures

marchmeena29/iStock by way of Getty Pictures

In my final article on the SPDR S&P Worldwide Dividend ETF (NYSEARCA:DWX), I mentioned how US equities have been at a pivotal level and the way looking for low-cost worldwide diversification was essential. Since then, DWX misplaced ~5% vs. a lack of ~12.6% for the S&P 500 and has clearly outperformed US equities. DWX continues to commerce at a pretty valuation and provides a ~4% dividend yield, which is far larger than what you will get should you put money into a high quality US dividend ETF. Nonetheless, the prospects of a worldwide recession have elevated significantly during the last couple of months, which provides extra draw back threat going ahead. Volatility will probably be a relentless function of this market and traders should not rush to purchase each single dip.

As a reminder, the SPDR S&P Worldwide Dividend ETF tracks the efficiency of the S&P World ex-US BMI, which offers publicity to the 100 highest yielding worldwide widespread shares which have handed sure sustainability and earnings progress screens. You can see under a current breakdown of the highest 10 holdings, and you’ll learn extra concerning the technique in my previous article.

Morningstar

Morningstar

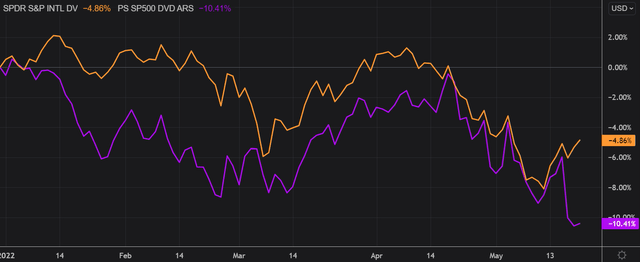

I’ve in contrast under DWX’s value efficiency in opposition to the iShares Worldwide Choose Dividend ETF (IDV) during the last 5 months to evaluate which one was a greater funding. For the reason that starting of the yr, DWX underperformed IDV by a ~2.4 share factors margin.

Refinitiv Eikon

Refinitiv Eikon

Nonetheless, the technique carried out properly in comparison with US dividend-paying ETFs such because the S&P 500 Dividend Aristocrats ETF (NOBL), and extra broadly talking, it did significantly better than any plain vanilla S&P 500 ETF.

Refinitiv Eikon

Refinitiv Eikon

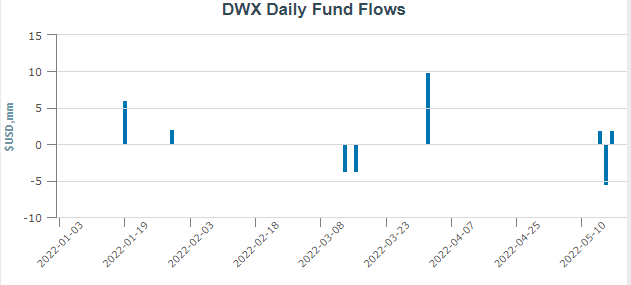

Traders’ curiosity within the fund held up comparatively properly. Regardless of shedding cash for shareholders within the first 5 months of the yr, DWX registered $8.3 million in inflows over that interval. As traders are actually anxious about inflation and a possible recession, I consider sentiment is swiftly shifting from progress and tech shares to worth and dividend-paying securities.

ETF.com

ETF.com

When it comes to dividends, DWX continues to be extraordinarily enticing when put next with the totally different choices that traders have right now. As an example, DWX has a TTM dividend yield of ~4% vs. ~1.5% on the S&P 500. It is very important spotlight that DWX just isn’t an rising market ETF, the place you’d count on and require such a excessive dividend yield to compensate you for the extra dangers, however relatively a developed markets ETF the place you put money into international locations resembling Canada, Switzerland, and Japan.

Refinitiv Eikon

Refinitiv Eikon

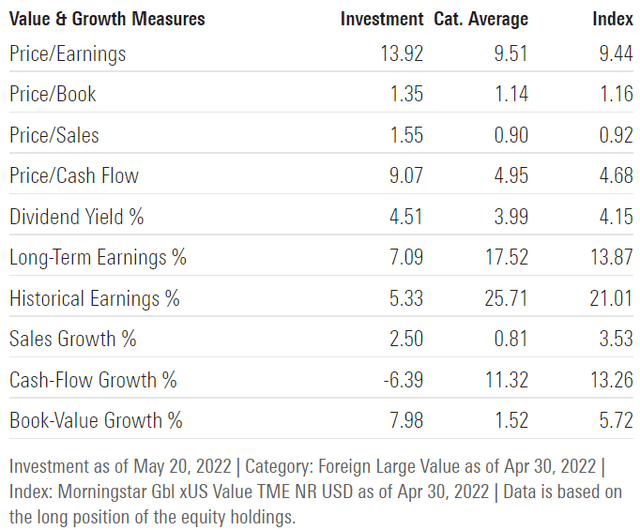

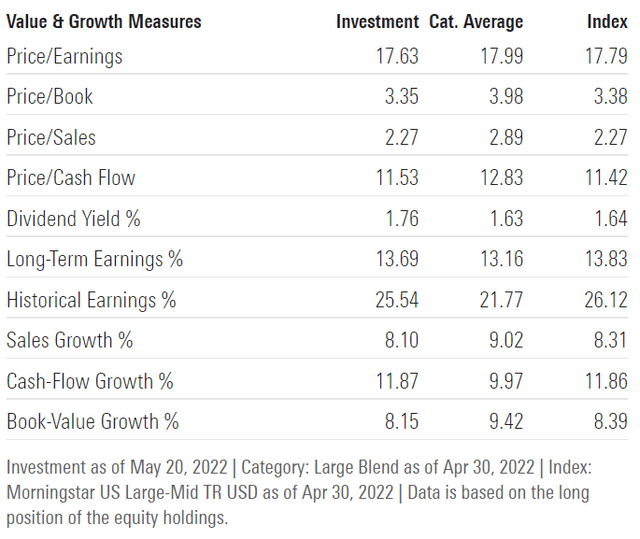

The excessive yield is just a perform of low valuations. If we take an up to date have a look at the multiples traders pay for DWX right now, it’s obvious it’s cheaper than an S&P 500 ETF. This fund trades at almost 14x earnings and has a price-to-book ratio nearer to 1. As compared, the S&P 500 trades at over 17x earnings.

Morningstar – DWX valuation knowledge

Morningstar – SPY valuation knowledge

Morningstar – DWX valuation knowledge

Morningstar – SPY valuation knowledge

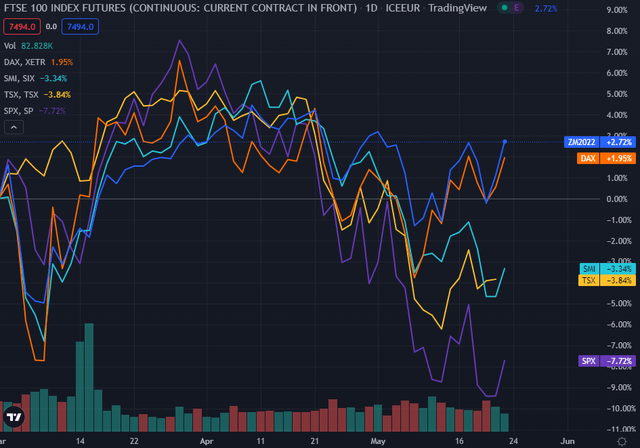

I personally consider valuations performed a giant function in limiting a few of the losses in numerous European and Canadian indices year-to-date. If we have a look at their efficiency in opposition to the S&P 500, all of them have outperformed American equities. The query now’s to find out if this development will persist going ahead, particularly with the specter of a worldwide recession.

TradingView

TradingView

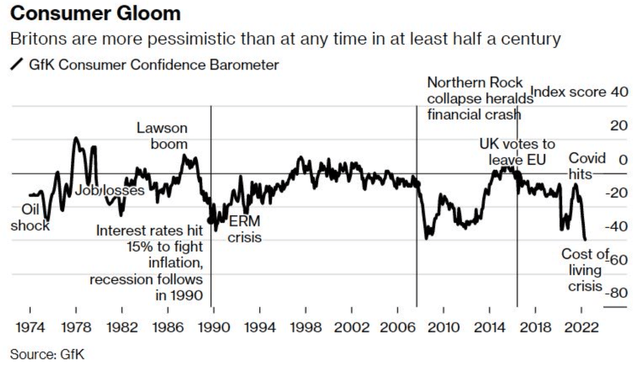

I feel there’s a good case to be made {that a} dividend fund with low multiples resembling DWX has a very good probability of outperforming the S&P 500 going ahead. That mentioned, volatility will probably be a key a part of the image and it’s unlikely that it’ll go away over the following couple of months. The fears of a worldwide recession are properly anchored by now in fundamentals and a few cracks are beginning to present up in numerous totally different locations around the globe. You possibly can learn extra about what’s going on in Germany in my last article on the country and on China, which is arguably probably the greatest indicators of worldwide commerce, here. Nonetheless, these will not be the one locations the place financial progress is on the tipping level. The UK lately posted one of many worst client sentiment numbers in 40 years, as shoppers face a price of residing disaster.

Bloomberg

Bloomberg

All in all, I feel there may be extra draw back threat from the present stage for DWX given how fragile the worldwide economic system is. I consider there will probably be many alternatives within the upcoming months to purchase this fund at a less expensive value, and affected person traders will probably be rewarded for not speeding into each single dip.

Worldwide dividend-paying shares proceed to commerce at enticing valuations and supply good yields, particularly when in comparison with what you will get within the US fairness markets. DWX isn’t any exception. The fund has a 4% dividend yield and high-quality constituents. Nonetheless, the chance of a worldwide recession has risen considerably in current months, thus rising draw back threat. Traders ought to count on markets to be unstable, which is able to create numerous shopping for alternatives at decrease costs.

This text was written by

Disclosure: I/we’ve got no inventory, possibility or comparable by-product place in any of the businesses talked about, and no plans to provoke any such positions throughout the subsequent 72 hours. I wrote this text myself, and it expresses my very own opinions. I’m not receiving compensation for it (aside from from Searching for Alpha). I’ve no enterprise relationship with any firm whose inventory is talked about on this article.